The Value of a Roosevelt Education

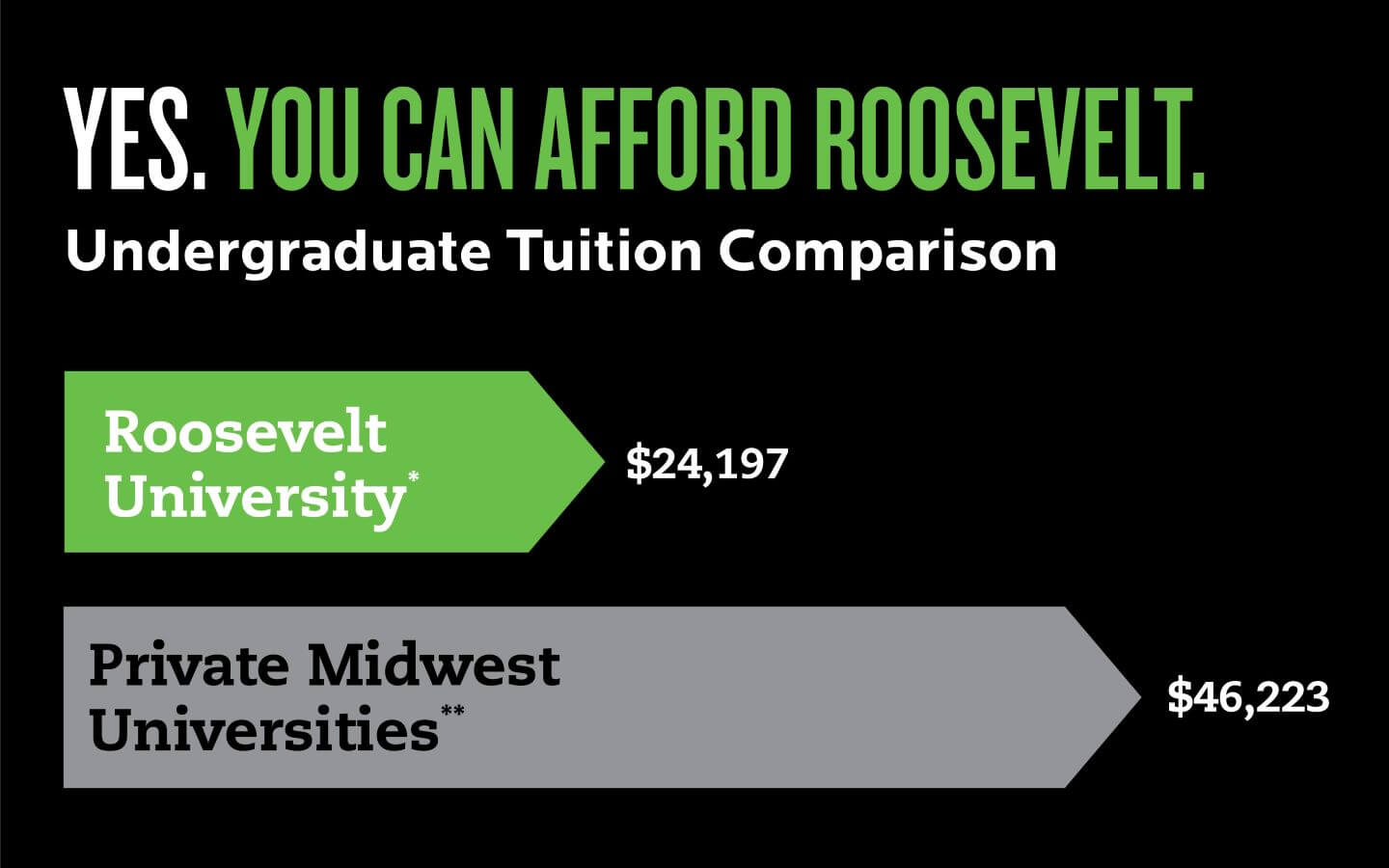

30% lower

cost of attendance than other private midwest universities

No housing

requirement

Students can choose to live on-campus or commute.

90% of

Roosevelt

undergraduates receive financial aid

Up to

$10K in

scholarships

for undergraduate students with 3.75 GPA or higher

Why Earn Your Degree? Because It's Worth It.

A college degree is more than a credential—it changes your life. At Roosevelt University, we prepare students not just for jobs, but for impactful careers and meaningful lives.

Higher Earning Potential

College graduates earn, on average, ($1.2 Million) 84% more over their lifetime than those with only a high school diploma.

Career Opportunities

Many high-demand jobs require a college degree. Employers look for skills like critical thinking, communication, and adaptability—hallmarks of a Roosevelt education.

Stability and Security

Degree holders face lower unemployment rates and are more likely to have benefits like health insurance and retirement plans.

Source: U.S. Bureau of Labor Statistics

Getting your degree is about more than just increasing your income.

HAPPINESS, GROWTH & CONNECTIONS

College helps you discover your passions, build lasting relationships, gain confidence, and develop a global perspective and gain a sense of purpose.

HEALTH & WELL-BEING

Engaging in meaningful extracurricular activities helps our students build resilience, manage stress, and develop coping strategies.

CRITICAL THINKING SKILLS

Through coursework that emphasizes analysis, problem-solving, and synthesis of ideas, our students learn to approach challenges from multiple perspectives.

EMPOWERMENT & ENGAGEMENT

At Roosevelt, we prioritize fostering self-reliance by teaching students to advocate for themselves, set goals, and achieve them. Emphasizing social justice, we inspire students to actively engage in their communities during and after their time with us.

Source: Postsecondary Value Commission (2021). “The Monetary Value of Economic and Racial Justice in Postsecondary Education: Quantifying the Potential for Public Good”

Why Choose Roosevelt for your Degree?

Affordable

Roosevelt has lower tuition and generous financial aid options.

Real-World Experience

Internships, service learning, and hands-on opportunities prepare you for life after graduation.

Support Every Step of the Way

From academic advising to career services, Roosevelt is dedicated to your success.