Invest in your future

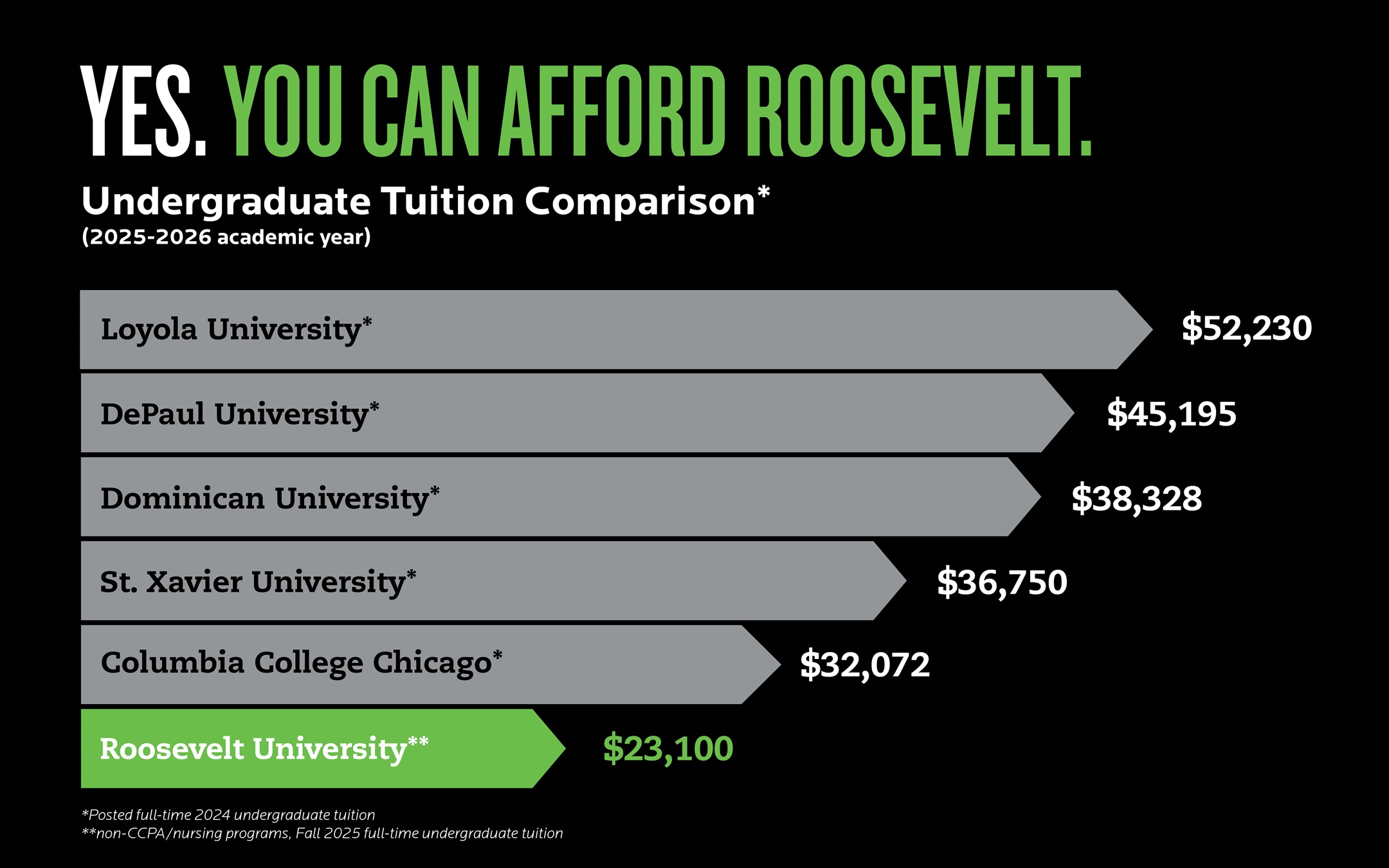

Roosevelt University is at the forefront of making higher education accessible and inclusive. Our $21,000 undergraduate tuition makes Roosevelt comparable to many public institutions.* This is one of the many ways Roosevelt tries to make the process of applying for college and financial aid as easy and transparent as possible.

*The undergraduate tuition for the Chicago College of Performing Arts for the 2024-2025 academic year will be $30,450.

ROOSEVELT STUDENTS CAN RECEIVE UP TO $20,095 IN AID AND GRANTS*

You may be eligible to receive a full tuition and fees offer if your GPA, major and financial need qualify.

Awards are a combination of Roosevelt aid, federal and state aid. Learn more below.

Roosevelt Aid

Based on your grade point average and EFC, you could be eligible for up to $6,000 in merit and need-based funds.

Federal Grants

The federal government distributes Pell Grant funds to students with the greatest financial need, based on your EFC.

State Grants

The Illinois Monetary Award Program (MAP) provides additional aid to state residents, based on your EFC. Complete the FAFSA at fafsa.gov as soon as possible to be considered for this time-sensitive program.

* Maximum aid possible for new undergraduate students in Fall 2023, excluding students from the

Chicago College of Performing Arts

+ Students that are IL residents

Student Employment

500+ work-study jobs a year

Through the Office of Career Development, you can apply for jobs to earn money and gain professional experience.

Tuition for 2023-24

Loans

Loans are borrowed from either the government or a private entity to finance expenses directly related to the cost of your education. This money must be repaid and is subject to the terms and conditions outlined by the lender.

Carefully consider all financial aid options before borrowing.

Federal Direct Subsidized Loans

The government pays the interest accrued on subsidized loans while you are enrolled in school.

Direct Unsubsidized Loans

You are responsible for the interest owed on unsubsidized loans while enrolled.

PLUS Loans

For qualified parents of dependent undergraduate students. Additional loan options are available to non-qualifying parents and students.

Private Loans

Consider all federal loan options before third-party private loans.